By AFRO Staff

In honor of National Financial Capability month, the AFRO reached out to staff members for tips and tricks on how to maintain personal funds. Read the excerpts below for suggestions on achieving success when it comes to managing your money.

Finance advice for different age groups

Bonnie Deanes

Bonnie Deanes

Bonnie Deanes, AFRO Finance Manager

Children:

Teach kids how to set goals on items that they want and contribute a portion of gift money and earned allowance towards the item cost. Make it a “matching” opportunity, where the parent contributes the same dollar amount as the child. It is a great source of encouragement!

Teens:

Teach the difference between wanting and needing to spend money. Parents can negotiate terms and agree to match savings for items their teen wants- just be sure to stick to it! Open a bank account and teach basic banking skills.

Young Adults:

Encourage young adults to start a retirement program (401k, 403b, etc) with an amount that they won’t miss each payroll. For guidance, base the minimum amount you want to save each month on the average amount you would spend on a night hanging out with friends or the cost of ordering lunch for a week. Really, the amount can’t be too small– just get it going and it will build. Try to commit to increasing the amount each time your salary increases.

Adults:

Ok…you are all the way GROWN! You work and can spend money any way you please with much attitude.

Be smarter with impulse buying. Do research on an item’s purpose, price and quality– or at least build in a 48-hour cooling off period on purchases more than a certain threshold. Set a spending limit for purchases, with categories for items such as clothing, electronics, furniture and vehicle costs. Remember you don’t have to have it just because you can buy it. Be true to yourself and don’t let envy take you on a trip to Broke Town!

Simplify your life in the same mindset as others who practice minimalist lifestyle. Make your purchases meaningful– not just to own more stuff. Be wise and spend your money on experiences with those you cherish the most. Material items are temporary. Your most valuable quality is your time and experiencing life.

Remember you can’t take it with you but be responsible with what has been given to you with both money and your time.

These are the many conversations I had with my dad, Robert L. Stanley, who worked to repair the printing presses for the AFRO in the 50s. I wish I would have followed them all.

*************************

Save, save, save

Denise Dorsey

Denise Dorsey

Denise Dorsey, AFRO Production Manager

Start saving while you’re young, you won’t regret it when you’re older! Be wise on how you spend your money– everything that’s new or the “latest and greatest” isn’t right for you.

*************************

Make your money work for you

Craig Talley

Craig Talley

Craig Talley, AFRO Media Sales Consultant

The finance mantra that I try to remember is something I heard from Myron Golden, a business consultant, best selling author and marketing consultant.

Golden reminds us that we have to understand the purpose of money!

Golden believes that low-income earners “think the purpose of money is to pay bills. That’s why they’re always broke!”

He says that Americans in the middle class “think the purpose of money is to save a little money, pay their bills on time so they can have a great credit score, to buy things they can’t afford,” while top earners around the world “understand that the primary purpose of money is to make more money! They learn to have their money go to work for them,” meaning they invest their earnings.

“It’s not that we don’t make enough money, but rather, we don’t make it fast enough,” says Golden.

*************************

Let the Bible be your guide

Nicole Batey

Nicole Batey

Nicole Batey, Special to the AFRO

One financial rule I live by is based on Malachi 3:10-11, give God His [tithe]first! Time and again, He has made a way for me, showering me with blessings on blessings and favor. He is faithful to His Word!

*************************

More money, more problems

Diane Hocker

Diane Hocker

Diane Hocker, AFRO Director of Community and Public Relations

Start saving early: Set up an automatic deduction from your paycheck that is automatically deposited into a savings account. Initially it will be painful but after a while, you won’t miss the money and it will grow over time.

Make a budget: Creating a budget is important in managing your finances and identifying where you can cut back on spending. It’s not easy to stick to the budget especially when you see those shoes you must have.

Avoid debt: In addition to student loans, credit card debt can become overwhelming and you may think it’s free money. WRONG. Avoid taking on more debt than you can handle. Go after the smaller balances and pay off debt as quickly as possible. This will also increase your credit score.

Tithing: I believe 10 percent of your gross income should be given to your church or any non-profit organization.

The bottom line, 10 percent should go to God–that is your tithe; pay yourself and avoid as much debt as possible without drowning.

*************************

Lessons Learned the Hard Way

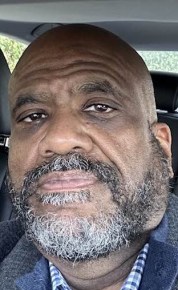

Ben Phillips

Ben Phillips

Ben Phillips, President of the AFRO – American Newspapers

Steer away from credit cards altogether if possible and especially credit cards with high-interest rates. If you need to utilize a credit card only charge as much as you can afford to pay off the charges each month to avoid any interest charges. If you do have a credit card that cannot be paid off every month, try to use the one with the lowest interest rate to keep your payment and interest rate down to a minimum. If you happen to have multiple credit cards, work to pay them down and eliminate the debt completely. You can also explore the option to consolidate multiple credit bills into one payment with low interest.

The statements in this article were edited for clarity.