By Megan Sayles, AFRO Business Writer,

Report for America Corps Member,

msayles@afro.com

While attending University of Southern California (USC), Michael Broughton ran into a problem.

He didn’t have enough money to pay for his tuition, and despite his efforts to obtain student loans, he was denied from a number of lenders.

“It kind of just taught me that there’s a lack of what I call ‘zero to one’ credit access and financial opportunity,” said Broughton. “That gap really got me thinking that it has to be more than just me, and it was. Americans are facing this gap issue, and I wanted to solve it.”

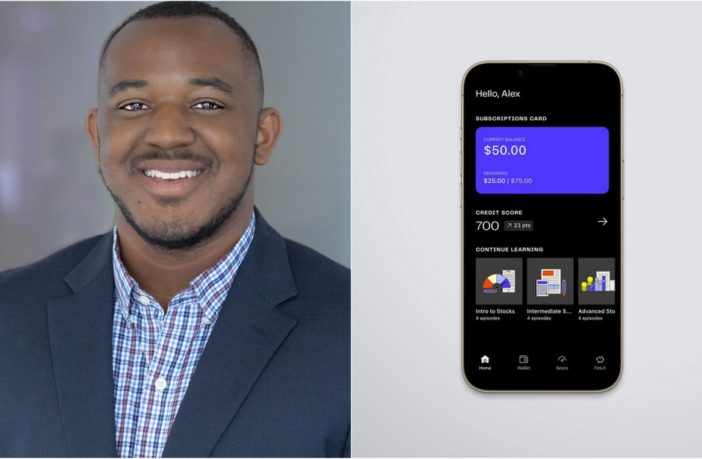

His solution came in the form of Altro, an application that allows users to build credit and financial power through recurring payments and subscriptions, including rent and Netflix plans.

In French, “altro” means “other,” and the word is representative of the platform’s target community who have been ignored or intentionally shut out of the U.S. banking system.

Although he knew nothing about entrepreneurship or the strategies for raising venture capital funding, Broughton ultimately dropped out of USC to dedicate himself to developing the app, which was created last year.

Initially, Broughton worked two jobs to bootstrap the business, but he eventually sought funding from pitch competitions.

He participated in hundreds of competitions before he perfected his storytelling and nailed down the perfect pitch.

Notably, Jay-Z’s venture capital firm, Marcy Venture Partners, discovered Altro at a pitch competition and invested a quarter million dollars in pre-seed funding. The firm continues to invest in Altro today.

When people use Altro, they are able to transform their non-traditional, recurring payments into trade lines, or records of consumer credit behavior. Once their account is set up, users are not required to return to Altro, but the app will display their credit score and how it has improved over time.

Altro is completely free to use, a factor that was critically important to Broughton.

“We, as a company, really focus on a couple of pillars, and one of those pillars is making sure that we’re as accessible as possible,” said Broughton. “I think putting a price tag on your ability to get access to credit is just a predatory practice, personally.”

Currently, Altro is exclusive to the Apple App Store, and it is available for use in states including California, New York, Illinois, Pennsylvania, Washington, New Jersey, Massachusetts, Texas, Florida, Wisconsin and Utah.

This year, Broughton is working to expand the app to all 50 states and bring it to the Google Play Store for Android users.

“People who have generated true wealth don’t manage their money, their credit or any of that stuff. They have people who know better than them and manage [their wealth]on their behalf and in their best interest. I don’t think you see that across anywhere other than the 1 percent,” said Broughton. “We really want to build those tools so people can have that level of concierge and expertise around their own personal finances although they are not part of the 1 percent.”

Help us Continue to tell OUR Story and join the AFRO family as a member – subscribers are now members! Join here!