By Mylika Scatliffe,

AFRO Women’s Health Writer

Marie Crest is like many other Black people in the United States. She is 36-years-old. She’s a mother of two sons with a third on the way. Crest works full time as an account consultant specialist for a national payroll company, but somehow, she receives regular collection phone calls and letters about outstanding bills– medical bills, to be exact.

Marie Crest, like many mothers across the nation, says the health needs of her children will always come first– even if it means increasing her personal debt. (Courtesy Photo)

Marie Crest, like many mothers across the nation, says the health needs of her children will always come first– even if it means increasing her personal debt. (Courtesy Photo)

“I probably have roughly $4,000 or $5,000 in outstanding medical bills going [back]to 2019, mostly for my sons,” said Crest. “I had to take my oldest for a consultation with a dental specialist about a chipped tooth. My portion of the bill was $1,200 and that was after what my in-network dental insurance provider paid.”

According to a report published by the National Consumer Law Center (NCLC) entitled “The Racial Health and Wealth Gap: Impact of Medical Debt on Black Families,” medical debt “remains a looming crisis that disproportionately affects Black households and communities, despite the aims of the Affordable Care Act.”

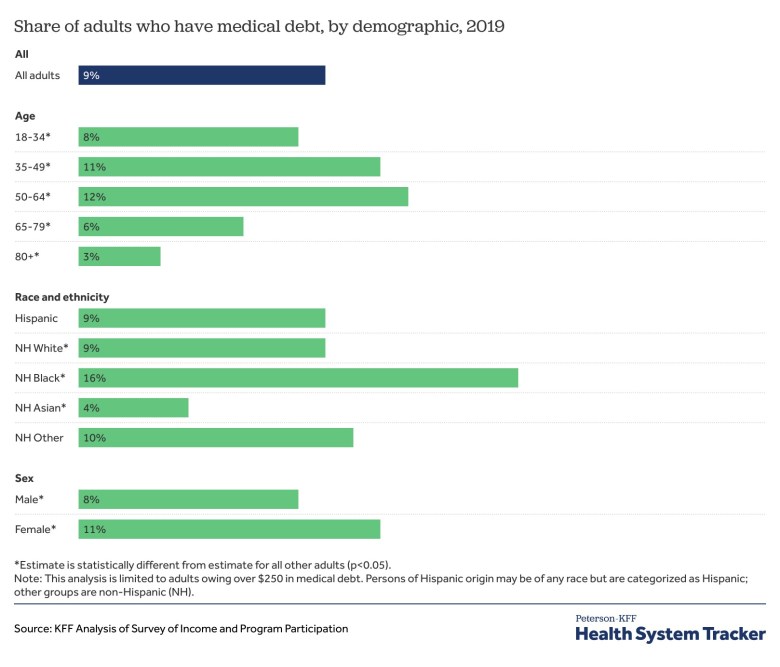

The NCLC reports that “sixty-two percent of bankruptcies are related to medical debt, one in three Black adults have past due medical bills, compared to fewer than one in four White adults, and 17 percent of Black adults lack health insurance compared to 12 percent of White adults.”

An analysis performed by the Kaiser Family Foundation last year shows that citizens who are chronically ill, low-income, uninsured, Black or Hispanic or live in states that have not expanded Medicaid eligibility as allowed under the Affordable Care Act, bear the heaviest burdens of medical debt.

“The disproportionate amount of medical debt carried by Black Americans goes back to the systemic disparities that go back as far as this country’s existence,” said Berneta Haynes, a staff attorney at the NCLC and author of the above-mentioned report.

Berneta Haynes is a staff attorney at the National Consumer Law Center and author of the report, “The Racial Health and Wealth Gap: Impact of Medical Debt on Black Families.” (Courtesy Photo)

Berneta Haynes is a staff attorney at the National Consumer Law Center and author of the report, “The Racial Health and Wealth Gap: Impact of Medical Debt on Black Families.” (Courtesy Photo)

In 2022, the Federal Reserve reported Black households had an average net worth of $340,599 versus $1.3 million held by White households.

“Less wealthy households have less ability to weather an unexpected financial crisis. A surprise $500 medical bill can send finances into a tailspin for someone living paycheck to paycheck,” said Haynes.

The history of Jim Crow segregation has a direct correlation to the racial health gap between Black and White people in America. Racist policies were embedded into all aspects of life and into every institution in the United States, including hospitals and health care.

“It looked different in the North and South. In the South, Black people had no access to hospitals while in the North, there may have been access– but the facilities and provided care were inferior,” said Haynes.

The passage of the Civil Rights Act of 1964 and the implementation of Medicare and Medicaid essentially ended hospital and health care segregation, but major inequities persist today.

“The racial wealth gap is only worsened by the racial health gap. The disparities in healthcare access, and healthcare quality, and health outcomes across race,” said Haynes. “What that means is Black households are more likely to be struggling with chronic conditions like heart disease and cancer. People dealing with these chronic conditions tend to have higher medical bills because they interface with the medical system more frequently. This creates medical debt for Blacks at a level you don’t see for Whites.”

While lack of health insurance or being underinsured has a strong correlation to high rates of medical debt, owning a health insurance policy does not eliminate the risk, as Crest can attest.

“Even with the amount I pay monthly for the insurance, there are still copays whenever we go to the doctor and additional bills for non-covered items that show up in the mail a couple weeks after each visit,” said Crest.

Crest’s younger son suffers from asthma and had a particularly rough few months last year. Her firstborn son suffered a concussion during a football game during fall.

“My youngest has to use three different inhalers, one of them alone is $75. After my oldest had the concussion, he had to have weekly doctor’s visits for several weeks and that was a $25 or $50 copay for each visit,” she said. “It’s insane how much it all adds up when I’m paying a monthly premium for coverage in the first place.”

After a bleeding scare early in her current pregnancy, Crest visited the emergency room where she had an ultrasound and bloodwork. She received an invoice of almost $12,000. After the health plan discount and the portion covered by the insurance provider, she was left with a balance of a little over $2,000.

Expenses like copays and coinsurance balances are not the only contributors to medical debt for people who are insured. In Georgia, where Haynes is located, narrow insurance networks are a significant obstacle.

A narrow insurance network refers to when an insurer has so few providers in the network that patients are forced to go outside the network to obtain care. The term also refers to when in-network providers are so far away that patients have little to no choice about choosing to be seen by out-of-network providers who are within a more reasonable distance.

Out of network care is always more expensive, subject to higher deductibles, and patients are responsible for a higher percentage of the cost of services rendered.

“Like most southern states, Georgia has never expanded Medicaid and narrow insurance networks are a common problem across the South– where the majority of Black people live,” said Haynes.

According to a recent report from the Urban Institute, of the 100 counties in the United States with the highest concentration of medical debt, 79 of them were in states that had not expanded Medicaid. Texas, where Crest resides, tops the list, followed by Georgia and North Carolina.

Attempts to avoid incurring debt leads to making difficult decisions about health care. Decisions like whether to buy groceries or fill necessary prescriptions.

“Delay of necessary care is a large contributor to medical bills. Delaying care could mean not going to the doctor or choosing to go without essential prescription medication. It’s also not purchasing healthy groceries. It all contributes to worsening health and eventually more medical bills,” said Haynes.

Crest emphasized she would never take chances with her children’s health needs, but she had to make a choice for herself in 2019 when she sliced her finger open while cooking.

“I know I should have gotten stitches but I just didn’t want to take a chance on racking up another bill,” Crest told the AFRO. “I’d been to an urgent care facility before that turned me away because I had an outstanding balance, so I called my friend who’s a nurse and she helped me.”

Haynes confirmed that in certain circumstances providers can refuse to provide care if there is an outstanding balance.

“Hospitals cannot turn anyone away if there is a true medical emergency and Medicaid patients can’t be turned away for any reason. However, hospitals can refuse to provide non-emergency care if there is an unpaid balance,” Haynes explained.

Fortunately, Maryland has new safeguards in place to assist those overwhelmed with medical bills. These include adopting measures where a person’s income level can trigger an automatic care requirement from hospitals that must provide help at no cost or at discounted rates. The measures also require hospitals to proactively screen patients to see if they qualify for financial assistance or other public assistance programs (e.g. Medicaid). Perhaps most importantly though, Maryland officials have set boundaries for when hospitals can initiate collection activity. Similar financial screening measures are in place in California, Colorado, Illinois and New Mexico.

Maryland hospitals must provide proof via affidavit that a patient has been offered a payment plan and puts restrictions on aggressive collection activity. Collection agencies and creditors cannot place liens against primary residences, seek civil arrest warrants, or garnish wages against patients eligible for free or discounted care. Going one step further than other states, Maryland has also set up a process to identify and reimburse money paid by impoverished hospital patients who paid for medicare care that should have been provided for free between 2017 and 2021.

The NCLC is a large network of attorneys that leverages policy expertise to address various consumer injustices faced by vulnerable populations including low income, elderly, and people of color. In addition to medical debt, these areas include energy, utilities, housing, lending, scams and fraud.