Last Updated on September 10, 2024 by BVN

Overview: Despite the Emancipation Proclamation in 1863, Blacks owned only 4.7% of national wealth, compared to 1.5% in 1963. The income gap between the top 10% and the bottom 10% is significant, with the latter earning $15,700 per year compared to the median income of $74,580 per year. The report highlights the need for economic strategies to close the income inequality gap, with Vice President Kamala Harris’s plan to build the middle class from the inside out as a potential solution. The former President Donald J. Trump’s plan to cut spending, increase tariffs, lower taxes, and end taxes on tips and Social Security payments is also discussed.

S.E. Williams

In 1863, during the midst of the Civil War and subsequent to the signing of the Emancipation Proclamation, Blacks owned one-half of 1 percent of the national wealth. Today, more than 160 years later although Blacks represent 13.6% of all U.S. households, collectively we hold only 4.7% of national wealth.

Even as income slowly rises among the working class, income inequality persists according to an August 2nd report by the St. Louis Federal Reserve (SLFR).

Closing the income inequality gap should be a top priority among presidential candidates this year especially in relation to the continuing, gross economic disparities. For example, those in the top 10% earn more than $150,000 per year. In addition, they own more than one million dollars in assets on average. On the other end of the spectrum, low income families earn, about $31,000 per year and their assets are basically non existent.

“The cause of that stagnation has largely been invisible, hidden by the assumption of progress after the end of slavery and the achievements of civil rights. But for every gain Black Americans made, people in power created new bundles of discrimination, largely hidden from sight, that thwarted, again and again, the economic promise of emancipation.”

Calvin Schermerhorn

The report was also careful to note that the income of the bottom 10% of earners is significantly lower ($15,700 per year) than the nation’s median income of $74,580 per year. This provides another perspective on the economic disparity.

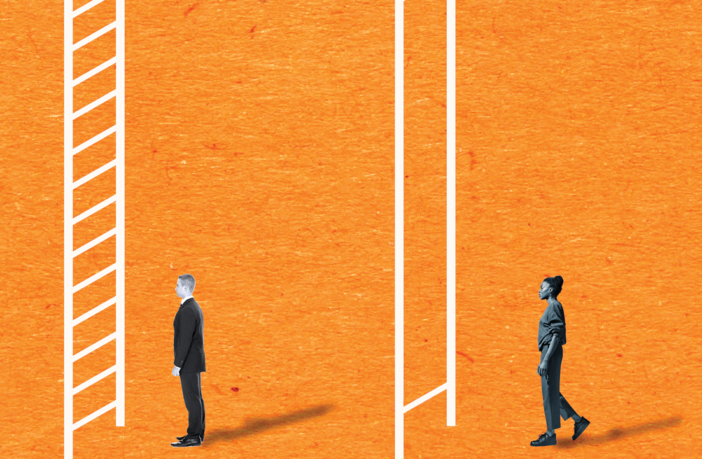

As should be evident to most, data also shows gender and race are key drivers of the persistent wage gap. People who work in the gig economy for example are primarily Latinx (31%) or Black (27%). In some places in the nation, those employed in this industry can earn as little as seven dollars per hour.

Purportedly, knowing the current state of wealth inequality not only reveals the size of the wealth gaps between different demographic groups, it also highlights which groups have the fewest resources, thus shining a spotlight on where opportunities exist to foster a more equitable economy.

As you head to the polls in November think about the economic proposals of each candidate and decide whether you feel former President Donald J. Trump and the Republican Party’s “tried and failed” trickle down theory of economics will help close the economic gap, or whether Vice President Kamala Harris’s plan to build the the middle class from the inside out, is the better plan. Here are some of the key economic strategies that sach candidate has revealed to date:

Summary of Some of the Key Economic Strategies of 2024 Presidential Candidates

Here are some other key points from the report to consider as you think about your choice for president in November.

The Measure of Wealth Inequality

The top 10% of households by wealth had $6.7 million on average. As a group, they held 66.9% of the nation’s total household wealth. In contrast, the bottom 50% of households by wealth had $50,000 on average and as a group, they held only 2.5% of total household wealth.

Current racial wealth gap?

On average, Black families owned about 23 cents for every $1 of white family wealth, while Latinx families owned on average about 19 cents for every $1 of white family wealth.

If you consider a generation to be about 20 years, then it’s been eight generations since the first Juneteenth celebration in 1865. Yet, the nation is no further along in finding a meaningful solution, let alone a sustainable solution, to this persistent and growing injustice of intractable wealth gap. Today a typical Black family has barely one tenth of the wealth of the typical white family. How many more generations will continue to struggle under such flagrant inequality? I, for one, say eight generations is enough.

Of course, this is just my opinion. I’m keeping it real.