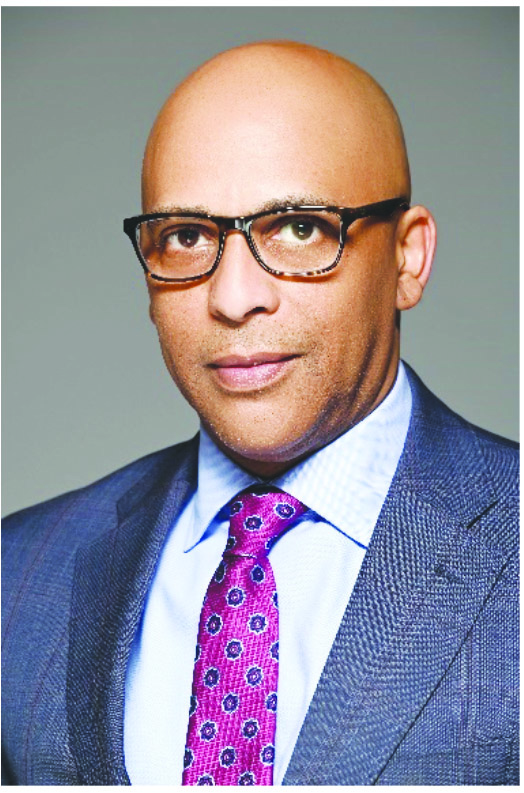

Germano Gomez

Germano Gomez

Sponsored Content

What is your role at The Harbor Bank of Maryland Community Development Corporation (“CDC”)?

Sign up for our Daily eBlast to get coverage on Black communities from the media company who has been doing it right for over 130 years.

I am the Managing Director of The Harbor Bank of Maryland Community Development Corporation (“CDC”). And what that means is that I oversee the strategy and operations for the CDC; specifically, I support the real estate development platform.

Although I’ve been at the CDC for 6 years, it feels like a lifetime, because really, all of my career and experience has culminated into this position. Through my 20 years in the industry, as a real estate developer, I’ve offered technical assistance, education, and owners’ representation for minority real estate developers and minority-owned projects throughout the city.

How does the CDC correlate with The Harbor Bank?

The CDC is the nonprofit affiliate of The Harbor Bank of Maryland.

There are four entities that are affiliates with Harbor Bankshares Corporation; The Harbor Bank of Maryland, Harbor Bank Community Development Entities, which focus on New Market Tax Credits, Harbor Bankshares Capital Corporation, which is a private credit and asset management affiliate, and the Harbor Bank CDC, which is a public charity engaged in economic and community development.

]]>

The CDC complements the Bank’s services by providing support to borrowers. We also support future borrowers by helping them get their financial situation aligned before they go over to the Bank. Our affiliation with Harbor allows us to create a path so the Bank doesn’t have to turn anyone away who’s trying to gain support for their business. If they can’t be qualified for services through the Bank, they’re ultimately referred to the CDC for assistance. This is key to our community’s development because we have been traditionally locked out of capital, access to capital, investment capital, and venture capital. Furthermore, the CDC doesn’t lend money without technical assistance because we realize that may put the borrower in a bad position; we try to look at our clients holistically. Our technical assistance is one of the things that make us unique because we can not only lend and/or invest in entrepreneurs, but then we can follow it up with assistance to make sure their endeavors are successful.

Tell us about some of your biggest initiatives.

On the real estate development side, one of our biggest initiatives is the Emerging Developers Program (“EDP”), which is a 15-week, soup-to-nuts, commercial real estate development overview course. The main benefit of the program is that we teach students the correct process, methods, and strategies of real estate development, we are essentially creating new minority-owned development companies. The one thing that most minority-owned developers don’t have: experience. So, to come to this class and benefit from my experience freely, is tremendous for our students.

Secondly, we’re creating quality housing. We set standards for the Emerging Developers. We don’t create slumlords. There is a rule that you cannot rent an apartment that you yourself wouldn’t sleep in. So, we are creating and maintaining integrity amongst the minority real estate development world because we are the ones who are developing our community.

]]>

Lastly, we are deepening relationships with the Bank. People come through a lot of times, and their first connection with Harbor is through EDP, and the whole goal is that they come to get technical assistance and then qualify for funding through the Bank. The Emerging Developers Program has had 280 graduates so far in 10 cohorts, which I’m really proud of.

Can you describe the history of the Haskins Center and the goal or principles it was founded on?

The Joseph Haskins Jr. Center for Community and Economic Development, also known as the Haskins Center, was developed in 2017 after the Freddie Gray uprising. One of the needs that the community expressed was a safe space for social entrepreneurs to address the needs of the Black community in Baltimore City. So, our CEO & President John Lewis, and former CDC, Vice President, Calvin Young, got together with community organizations and entrepreneurs such as, Leaders of a Beautiful Struggle, Black Girls Vote, and Project Pneuma. Collectively, they came up with the idea to create a coworking space here at the Haskins Center that organizations could operate from and share their common goal of responding to all of the outpour of anger that came from the Freddie Gray uprising. From there the Haskins Center opened on January 1st, 2018. There have been 50-plus tenants that have rotated through here in the past six years. Two of the original tenants are still here, Project Pneuma and Black Girls Vote.

The core principles behind the CDC are that Harbor Bank wants to wrap its arms around entrepreneurs to make sure they’re successful. Having organizations here on-site puts them in direct contact with resources and technical assistance all the way up to John Lewis. So, they have access to not only me as the Managing Director, but they also have access to the CEO & President.

]]>

What are you most proud of doing in your role?

I’m most proud of helping people. My goal in life is to be able to use my knowledge and resources to help push others forward. When I look back at the number of businesses that I’ve come into contact with over the past six years it’s over 1,000! Having the opportunity, the tools, and the platform that Harbor Bank affords me to help our community is one of my biggest accomplishments and my main goal.

What would you say are the specific current goals of the CDC moving forward?

One is to expand our entrepreneur technical assistance platform through the Black Founders Table and Black Tech Saturday activities. The Black Founders Table is an extension of the work that we’re doing with the Equity Brain Trust. They are wrapping their arms around 12 Black tech company founders in order to move the needle on how venture capital procurement and inclusion are handled and managed for minorities in Baltimore City. The other goal is to invest in, build, finance, construct, own, and manage commercial real estate for the benefit of the CDC operations and the communities in which the projects are located.

]]>

Why is the Bank and CDC so important to Baltimore?

Well, we are the last minority-owned, Black-owned financial institution headquartered in the state of Maryland; and the only commercial bank founded and headquartered in Baltimore City. We are important to this city because traditionally, systematically, and legislatively, Black Baltimoreans have been denied access to capital, ownership rights, healthcare services, and community amenities. We are in the spirit of the Bank’s origin, which was to provide loans to businesses and individuals because they couldn’t get loans from other financial institutions.

That has evolved into the deployment of $500 million in New Market Tax Credits in key areas of the city. So, we’ve taken $2.6MM in capital in 1982, to now having created billions of dollars of economic impact to grow our communities. That’s why we’re all important, we want to continue being a part of the change that we want to see.

Is there anything coming down the line as far as events, campaigns, programming, or initiatives that you would like to alert the readers to?

We have several things on the entrepreneurial side, look out for Black Tech Saturdays! Our last event had over 200 people in attendance so the momentum is great. We’ll continue to support it, but we’re happy to see that it has now garnered support from state legislators, city government, and some other private philanthropists. So, we’re looking for that to really grow. Also, I would say look for bigger real estate development projects. We received a Department of Housing & Community Development (DHCD) Project C.O.R.E. grant of $250,000 for a 50-unit, mixed-use building that we’re doing in partnership with Okoro Development. Additionally, we are supporting Coppin State’s “Live Near Your Work” initiative with 13 single-family lots that are under contract to be renovated for faculty. The initiative provides down payment assistance to compensate employees, nonprofit workers, and all state employees who want to live in these homes. If we can continue our partnership, I think we’d want to be responsible for building up Coppin State and its surrounding areas, similar to how Morgan State and Johns Hopkins has grown and flourished throughout the years. We want to see some equity in West Baltimore for such a prestigious and valuable institution for the Black community. Long term, we want to create housing opportunities, community amenities, and retail opportunities, for the residents and businesses on the West side of Baltimore as well.

Get your AFRO A CARD today!

Help us Continue to tell OUR Story and join the AFRO family as a member. Members will receive exclusive journalism, and directly support the future of the AFRO. You can choose from three membership plans below.