A 2024 study from Lendio, a business specializing in small business loans, has ranked the top 20 states for diverse and minority entrepreneurs. The list was curated based off of eight critical metrics including small business loan accessibility, job growth, income equality and current entrepreneurship rates.

“By shedding light on these issues, we aim to spur action towards leveling the playing field for all entrepreneurs,” Lendio CEO Brock Blake shared. “We applaud the governments and organizations working to provide policies and resources that support these underserved communities and are excited by new technology advancements in loan underwriting that will make access to capital more equitable.”

Here are the most interesting finds of the survey:

Numbers Don’t Play a Factor

Surprisingly, there was very little correlation between the top states and states with the most minority-owned businesses. For example, the state of Hawaii had the most minority-owned businesses in the country, accounting for 50.87% of the region’s entrepreneurs, but were ranked as the 32nd best state for minority entrepreneurs. The only state to appear on both lists was Maryland, which ranked 11th overall and 5th in population.

This correlation is likely due to the fact that minority business ownership rates were lower relative to the state’s minority population, along with other factors analyzed.

“Access to funding is critical to the success of a small business, but there is a lending gap experienced by minority entrepreneurs,” Blake commented. “This disparity, where white entrepreneurs outpace their Asian, Hispanic and Black counterparts in securing funding, is a clarion call for targeted policies and programs to bridge this inequality.”

Vermont, Wyoming and the Dakotas Take the Lead

Vermont secured the number one spot for states with the best conditions for minority entrepreneurs. They showed a high percentage of business loan approvals per 10,000 residents at 34%, a 93% increase in job growth of Minority Business Enterprises (MBEs), an increase in minority-owned startups and had low unemployment and income disparity rates.

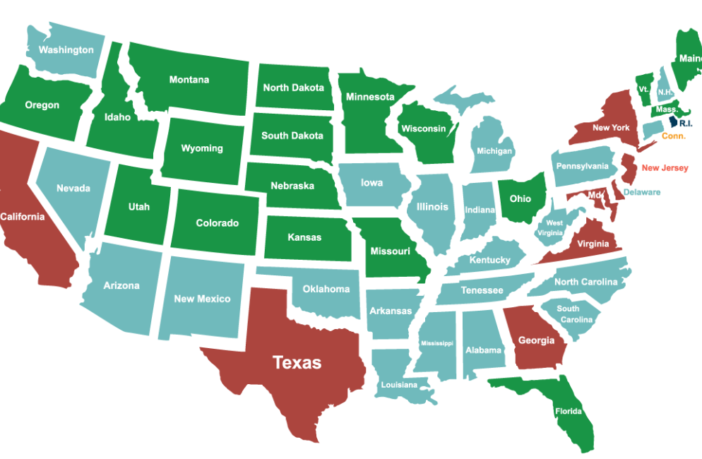

The full top 20 list is as follows:

Vermont

Wyoming

South Dakota

North Dakota

Montana

Maine

Utah

Kansas

Minnesota

Maryland

Idaho

Oregon

Colorado

Missouri

Nebraska

Florida

Ohio

Wisconsin

Massachusetts

Alaska

Hawaii and Washington D.C. Show the Highest Numbers

As briefly mentioned, Hawaii had the most minority-owned businesses at just over 50%. This is likely due to Hawaii’s population, where 78% of the state’s residents are diverse. However, their lower access to capital and decreased startup rates prohibited them from scoring higher on the top 20.

Washington D.C. also scored high in population categories. Scoring second, D.C. is home to 29.45% of the minority-owned businesses and has the most Black- and African American-owned businesses at 15.17%.

The states with the most minority-owned businesses also tend to be states with higher diversity populations overall.

The top 10 states in this category are:

Hawaii: 50.87%

District of Columbia: 29.45%

California: 26.21%

Georgia: 22.39%

Maryland: 22.18%

New York: 21.39%

New Jersey: 20.53%

Virginia: 19.75%

Texas: 18.06%

Delaware: 15.69%

Overall Growth and Changes to Make

Fortunately, regardless of the state, the number of Black, Hispanic and Asian American businesses in particular are reaching record heights. In 2020, there were about 1.2 million diversely-owned businesses in the United States, more than doubling the rates in 2007.

However, the amount of minority-owned small businesses nationally only stands at about 20%, despite making up about 40% of the total population. While there are potentially several factors to blame, one of the biggest comes from the likelihood of approvals for business loans. According to survey results, about 52% of white entrepreneurs were fully approved for financing, while only 35% of Asian-, 28% of Hispanic- and 27% of Black-owned businesses were approved.

While there are increased funding opportunities being made available to diverse business owners in recent years, it’s important to remember that there are still improvements to be made and more effective models, as shown in the top 20 list, that can be followed.

Explore more articles for the Hispanic Community here.