The streaming market continues to be ultra-competitive, with streaming pure-play companies, media giants and others launching and growing their own platforms. Companies are looking for an edge with the release or original shows and movies, live sports and other exclusives.

(L-R) Greg Tarzan Davis and Danny Ramirez attend a special Los Angeles Screening and Q&A of Paramount Pictures’ “Top Gun: Maverick” at Paramount Studios Sherry Lansing Theatre on December 07, 2022, in Los Angeles, California. Top Gun: Maverick was a box office hit in 2022 as it appeared in Paramount Plus. JOE SCARNICI/BENZINGA

Here’s a look at the latest from Paramount Global and how it stacks up to rivals.

Paramount Global reported revenue of $8.13 billion in the fourth quarter, which was up 2% year-over-year. The company reported direct-to-consumer revenue of $1.4 billion, up 30% year-over-year.

In the fourth quarter, Paramount added 9.9 million subscribers for its Paramount+ streaming platform to hit a total of more than 56 million. The company added 10.8 million total global direct-to-consumer subscribers in the fourth quarter to bring the total to 77 million across several platforms.

“Paramount continues to demonstrate the success of its global multi-platform strategy, with popular content at its core. Nowhere was this more evident than in the growth of Paramount+, which added a record 9.9 million subscribers in the fourth quarter,” Paramount CEO Bob Bakish said.

Paramount also announced it will raise the prices of its streaming service as it rebranded to combine with Showtime in the third quarter of 2023. The new platform will be called Paramount+ with Showtime.

Prices with Paramount Plus are expected to see prices hike with the Showtime merger as new prices had been announced, according to USA Today.

“We all know streaming represents incredible value for consumers and the Paramount Plus offering is far from the industry price leader. We are on the value end of the pricing spectrum,” Bakish said on the company’s earnings call.

The fourth quarter report came on the heels of a 13F filing showing that legendary investor Warren Buffett increased the position of Paramount in Berkshire Hathaway Inc. Buffett’s company added 2.4 million shares of Paramount in the fourth quarter. Berkshire Hathaway has been buying Paramount shares every quarter since 2022 and now owns around 15% of the company.

Paramount ended the fourth quarter with 56 million subscribers for Paramount+. Here’s how that stacks up to rivals.

The Walt Disney Company ended the first quarter with 161.8 million Disney+ subscribers, including 46.6 million domestic subscribers.

Disney’s totals were up on a year-over-year basis, but the company saw its first subscriber drop for Disney+ since the platform launched due to lower subscribers in Southeast Asia.

Disney also owns a majority stake in streaming platform Hulu, with Comcast Corporation owning the remaining stake.

Hulu ended the fourth quarter with 48 million subscribers, up from 47.2 million in the fourth quarter.

Netflix Inc ended the fourth quarter with 230.75 million paid subscribers. The company added 7.7 million subscribers in the fourth quarter, beating company estimates of 4.5 million.

Peacock, a streaming platform from Comcast, ended the fourth quarter with around 20 million paid subscribers in the U.S., adding 5 million net new subscribers. The company posted its best quarterly results for Peacock since launching in 2020.

Warner Bros. Discovery ended the most recent quarter with a combined 95 million subscribers for its HBO, HBO Max and Discovery+ platforms. The company will merge its HBO Max and Discovery+ streaming platforms in the spring of 2023. The company added 2.8 million global subscribers in the third quarter, including around 500,000 in the United States.

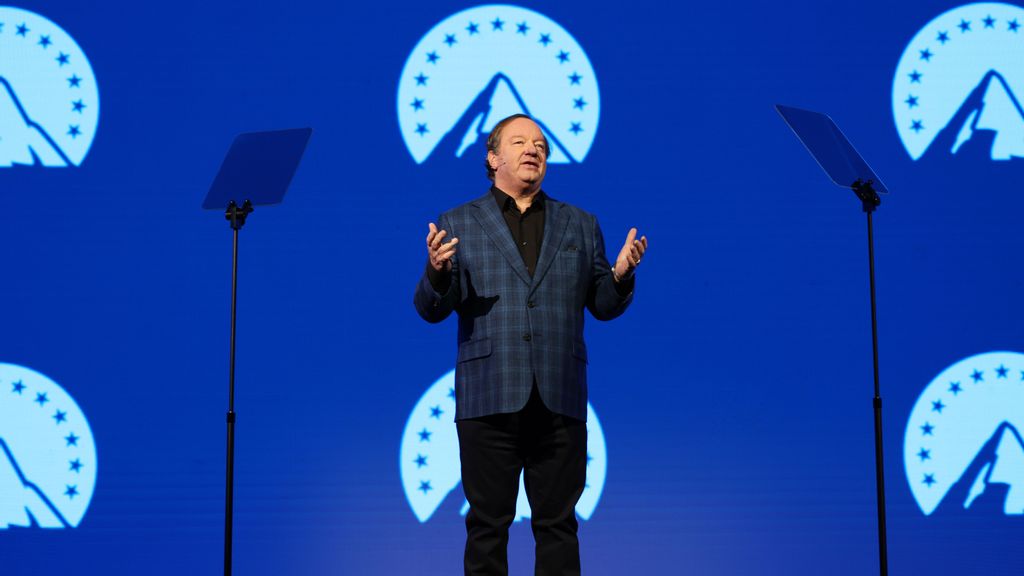

President and Chief Executive Officer of Paramount Global Bob Bakish speaks at the Velocity Showcase at the MTV Europe Music Awards 2022 held on November 12, 2022, in Duesseldorf, Germany. Paramount Plus is now merging with Showtime that would increase its prices in subscriptions both with and without ads. ANDREAS RENTZ/BENZINGA

President and Chief Executive Officer of Paramount Global Bob Bakish speaks at the Velocity Showcase at the MTV Europe Music Awards 2022 held on November 12, 2022, in Duesseldorf, Germany. Paramount Plus is now merging with Showtime that would increase its prices in subscriptions both with and without ads. ANDREAS RENTZ/BENZINGA

Streaming platforms from Apple Inc and Amazon.com Inc do not break out the number of subscribers. Both platforms have been competitive at adding more content like live sports to capture additional subscribers.

One of the key themes for streaming companies has been a focus on profitability as the platforms grow and reach significant numbers of subscribers. This has led to cost cuts on content and also price increases for customers.

Paramount said it will raise the cost of its streaming platform from $9.99 to $11.99 per month for the new Paramount+ with Showtime launch later this year. A plan with advertising will go up in price from $4.99 to $5.99 per month.

Paramount Plus attributed to success on the streaming platform that included the NFL on Sundays, that included additions to Top Gun: Maverick, Yellowstone, and Criminal Minds, according to CNBC.

“The general entertainment space may not make sense for everyone, but it clearly makes sense for us when we look at our asset combination,” Bakish said, when Paramount Plus was first marketed as a strategy to be the leading service in entertainment and sports.

Content was the main driver for Paramount Plus to increase subscribers, according to The Hollywood Reporter.

“Subscriber growth was driven by a strong content slate, including the NFL, the expansion of existing franchises like Top Gun: Maverick and 1923, the success of new franchises like Tulsa King and Smile, as well as CBS’ overall entertainment slate,” the company said. “Internationally, Yellowstone and Top Gun: Maverickwere top acquisition drivers for the service.”

Disney+ with ads has a price point of $7.99 per month. The company’s Disney+ without ads plan costs $10.99 per month.

Hulu with ads is $7.99 per month. Hulu without ads is $10.99 per month.

Disney also offers combo plans of Disney+ and Hulu. The plan for both with ads is $9.99 per month and the plan for both without ads is $19.99 per month.

Netflix has price points of $6.99 for a plan with advertisements, $9.99 per month for its basic ad-free plan and $15.49 per month for its most popular Standard ad-free plan.

HBO Max with ads is $9.99 per month. HBO Max without ads is $15.99 per month. The company increase the monthly cost of the ad-free plan in January for the first time since the platform launched.

Peacock with ads is $4.99 per month. Peacock without ads is $9.99 per month.

AppleTV+ is $6.99 per month.

Amazon Prime Video is available to all Prime subscribers. Amazon Prime has a cost of $14.99 per month. A standalone Prime Video membership without the benefits of free shipping and other Amazon features is $8.99 per month.

Netflix and Disney both launched ad-supported plans in 2022 after previously only having premium subscriber models available without commercials.

Produced in association with Benzinga.