By Megan Sayles,

AFRO Business Writer,

msayles@afro.com

Four years ago Carl Brown began writing a story about a young boy named Sammy. He was not a regular boy. Sammy possessed an alter ego with a superpower that helped him and his friends to make smart financial decisions.

With the help of a Citi Foundation grant in 2023, Brown’s story was turned into a comic book series to teach youth, particularly children of color, about financial literacy.

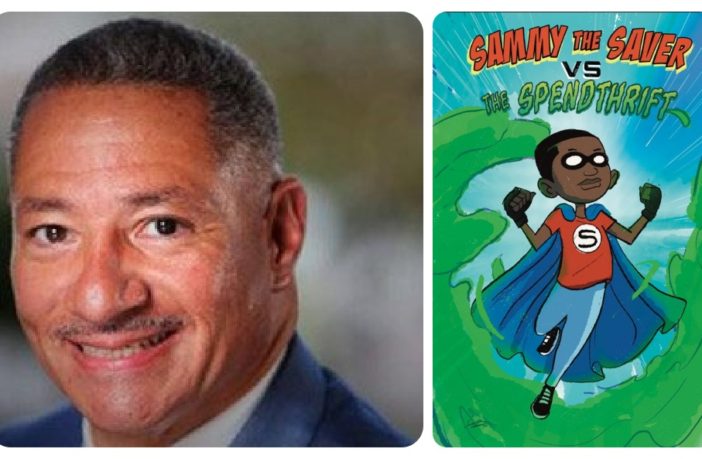

Carl Brown, executive director for the D.C. Small Business Development Center, created the book “Sammy the Saver” to teach children about financial literacy in their early years. (Photo courtesy of Carl Brown)

Carl Brown, executive director for the D.C. Small Business Development Center, created the book “Sammy the Saver” to teach children about financial literacy in their early years. (Photo courtesy of Carl Brown)

“I kept seeing a lot of TikTok videos of artists, entertainers and athletes saying they wish they knew about financial literacy, and I thought it was important for young kids to understand financial literacy,” said Brown, who is executive director for the D.C. Small Business Development Center (SBDC). “The story is about three kids saving up their money to go to the ‘Queen Bee’ concert.”

In the first “Sammy the Saver” issue, Sammy and his friends, Katrina and Cash Money Carl need $400 each to purchase a Queen Bee concert ticket. After Sammy asks for a handout from his father, he gives Sammy $100 and tells him to invest it into a business to earn the money he needs.

“With Sammy, what we’re trying to teach young kids about is six main concepts and basic math,” said Brown. “The concepts are saving, spending, investing, earning, budgeting and debt.”

Sammy teams up with his friend Katrina to start a T-shirt business, and the pair make enough money to buy tickets. Meanwhile, their friend Cash Money Carl gets taken over by the Spendthrift and blows all of his money before being able to snag a concert ticket.

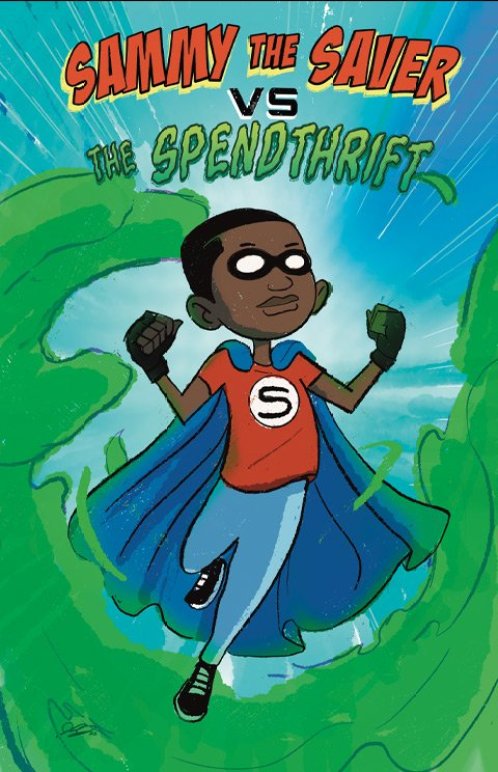

After a grant from the Citi Foundation, “Sammy the Saver” is now a full-on comic book. (Photo courtesy of Carl Brown)

After a grant from the Citi Foundation, “Sammy the Saver” is now a full-on comic book. (Photo courtesy of Carl Brown)

Sammy’s alter ego, Sammy the Saver, steps in to fight off the Spendthrift and helps Cash Money Carl sell some of his recent purchases in order to buy the desired concert ticket.

Brown’s team called on CreativeJunkFood, a Black-owned creative studio in Washington, D.C.’s Ward 8, to assist in creating the comic. Founders Candice Taylor and Nabeeh Bilal managed the art direction for the book and helped with concept development and writing.

“We could’ve just done a textbook. [But] by adding creativity, we’re able to extract ideas. Take a character like ‘The Spendthrift.’ This is something that can inhabit anybody, and it’s the idea that you spend outside of your means and make poor financial decisions,” said Bilal. “Sammy senses those things, and he’s able to impart financial literacy principles on people who have come under The Spendthrift and rid them of it, so they don’t end up with generational curses. We take colloquialisms and mix them with academics to make it fun to learn.”

Thus far, the creators behind “Sammy the Saver” have circulated thousands of copies of the book. They’ve also frequented local schools and libraries to present the book to children and talk to them about the importance of financial literacy.

In the future, the team is also preparing to roll out a narrated version of the comic book, as well as new issues and a coloring book featuring Sammy and his friends.

“I hope that the youth take lessons from the characters’ stories, and they don’t end up like Cash Money Carl did with having to be bailed out by people,” said Bilal. “I hope that they see themselves as stewards of their financial journey but also that they’re able to impart some wisdom on people around them should they make poor decisions or should they come to a crossroads financially.”

Megan Sayles is a Report for America Corps member.